I am not alone. I am a mother of three children, I love Florida, and I want the absolute best educational outcomes for my kids. I am also not alone in that I want educational choices that efficiently and effectively produce the greatest citizens and souls for my state and my nation. I am certainly not alone in recognizing the social, educational, and financial failures of our modern American educational system. Unfortunately, today’s common response to our school crises, unfolding in various forms of “School Choice” legislation, may not liberate us from any of these disasters.

In fact, over time, not only will many of these disasters be propagated under School Choice legislation, but the proposed “wins” expected by this trojan horse of legislation will quite assuredly have its offsets—in parental freedom, education independence, and unsustainable tax ramifications. The fundamental components undergirding a flourishing society and the bedrock of our nation and state—independent education, parental autonomy, and private funding—face new peril under Universal School Choice policies. As I advocate for Florida families and liberties by way of legislation and grassroots initiatives—from confronting misleading claims to exposing “linguistic theft” in legislative conversations—I can see the house of cards growing, and I am compelled to speak out. Thankfully, I am not alone.

A Warning about School Choice

There are a lot of eyes on Florida now that it has pushed forward School Choice legislation. Social media is abuzz with the topic, and other states are watching or pushing through their own versions. During the 2023 Florida Legislative Session, I urged Legislators to keep the “Free State of Florida” free. Instead, Florida leaders became enamored by Universal School Choice, and freedoms were confiscated. Now, two years later, Texas has SB2 on the table, their Universal School Choice bill. Texas families are fighting for their education independence, and again, many are not aware of what will be confiscated by “School Choice.”

Will others see the impact of the bill with the clarity of Alice Linahan, Vice President of Women on the Wall and founder of Voices Empower? She testified during a Texas SB2 Senate Education Committee, calling it “…the illusion of choice while placing significant restrictions on parents and giving unfettered authority to unelected bureaucrats.” Pray that the vacillating contingencies from both sides of the aisle awaken to the downstream ramifications of this pathway. What can they learn from what we’ve already seen undergirding our current educational system and Florida’s progress down this School Choice path so far?

There is a gorilla in the room of American education. Schoolhouse Rocked: The Homeschool Revolution states that there is “a well-orchestrated takeover of education being promoted by UNESCO and being driven by big-money interests. It isn’t grassroots. It isn’t conservative. It doesn’t benefit families.” Florida has willingly entered the snare of a foothold trap—we have been captured!

According to a 2021 report commissioned by UNESCO, the United Nations (U.N.) educational agency, “Governments should use tax subsidies, including vouchers, education savings accounts, and scholarship tax credits, for private schools to impose government control and regulations for requiring “equity” and other goals.”1 We must recognize when components necessary to roll out School Choice contain the same ways and means proscribed by our socialist gorilla. This alone is reason enough for immediate concern: why is Florida attempting to make School Choice work More and more legislation unfolds when a new policy shifts an equilibrium.

School Choice and Florida

Florida’s School Choice Bill

In his January 10, 2025, Executive Order, Governor Ron DeSantis announced “School Choice Success” since House Bill 1 (HB1) was signed in March 2023, and further stated, “In total, nearly 1.4 million students are utilizing a school choice option in Florida.”2 HB1 made Florida’s education vouchers universal. Under this law, there is no longer an income eligibility cap for K-12 participants, and most K-12 students can receive vouchers to either be home-schooled or attend private school.3 The significant cost of this expansion—upwards of $4 billion4—will have major impacts on public school budgets for the foreseeable future. The 2024 legislative session was marked by bills that sought to correct aspects of HB1’s implementation, particularly around accountability. For example, HB1403 passed in the 2024 legislative session, enacted some accountability provisions and, pursuant to HB1 (2023), provided an overhaul of the K-12 education code.5

Florida’s Public School Report Card

Why are Florida leaders, and even President Trump,6 so enticed by the School Choice paradigm? In the words of Nicki Truesdell, School Choice is “the U.N.’s puppet master.” Aren’t we building upon a house of cards? Consider the U.S. Department of Education (U.S. DOE) recently released statement in response to the public disclosure of scores from the 2024 National Assessment of Educational Progress (NAEP), often called The Nation’s Report Card:

“Today’s NAEP results reveal a heartbreaking reality for American students and confirm our worst fears: not only did most students not recover from pandemic-related learning loss, but those students who were the most behind and needed the most support have fallen even further behind. Despite the billions of dollars that the federal government invests in K-12 education annually, and the approximately $190 billion in federal pandemic funds, our education system continues to fail students across the nation.”7

Not surprisingly, Florida’s statistics reflect the U.S.DOE findings in general and substantiate Florida citizens’ concerns over its yield on investment from both academic and financial points of view. See the key educational results below for Florida. How many times have you seen politicians celebrate with great fanfare their districts’ scores, scores that, in reality, are only slightly better than these grossly underperforming inadequacies? Is it reasonable to expect that rearranging the deck chairs with School Choice will solve these problems? We have already had school choice: we have had the choice to educate our children at public, private, charter schools, micro-schools, home schools, etc. We just haven’t had the choice to do it with other people’s money. (As to the argument that “it’s my money anyway,” see below). We may, therefore, become quite unclear about what positive impact will come of School Choice. However, we can predict with some clarity the negative impacts from it. What are the costs of trying to make School Choice work for us?

| FLORIDA GRADE 8: National Report Card | |

| Mathematics | |

| SCALE SCORE

262 = Basic 299 = Proficient 333 = Advanced |

SCALE SCORE

2022 = 271 2024= 267 1.5% decline |

| Reading | |

| SCALE SCORE

243 = Basic 281 = Proficient 323 = Advanced |

SCALE SCORE

2022 =260 2024= 253 2.7% decline |

| FLORIDA GRADE 4: National Report Card | |

| Mathematics | |

| SCALE SCORE

214 = Basic 250 = Proficient 282 = Advanced |

YEAR/SCORE

2022 = 241 2024 = 243 .83% increase |

| Reading | |

| SCALE SCORE

208 = Basic 238 = Proficient 268 = Advanced |

SCALE SCORE

2022 = 225 2024 = 218 3% decline |

Florida’s Education Budget

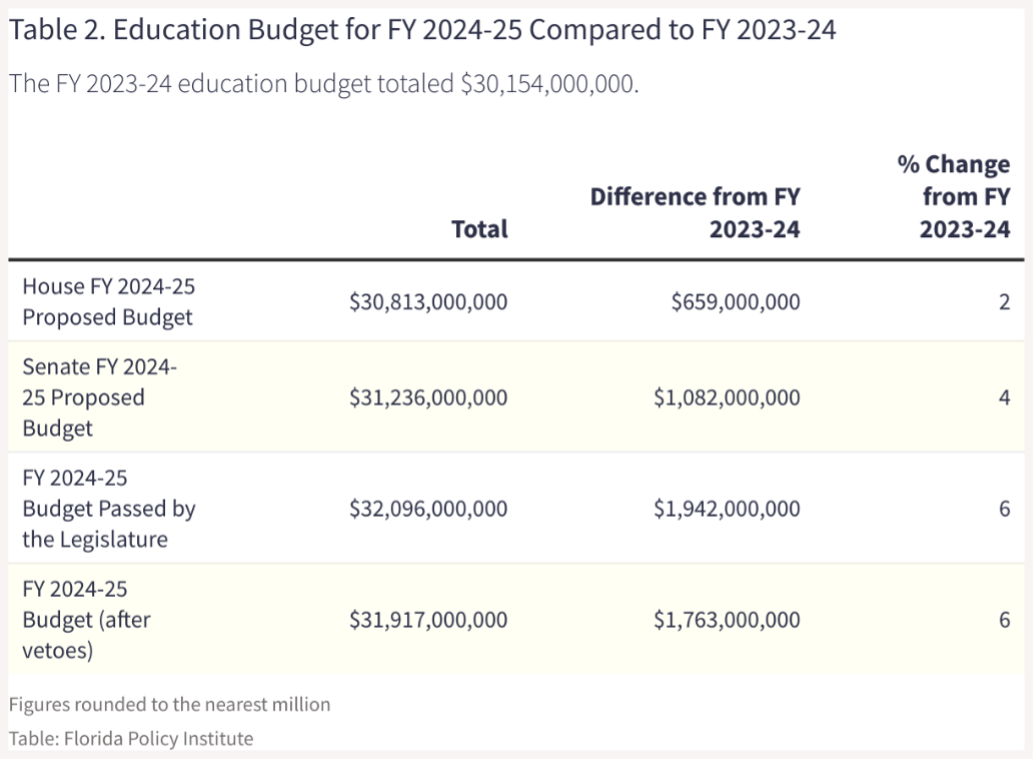

According to the Florida Policy Institute and Education Law Center, “As vouchers continue to increase, there will continue to be a significant impact on public school budgets. While statewide revenue is projected to increase through FY 2027–28, the pace of the increasing costs of education, an important budgetary driver, is expected to outstrip growth in revenue and eat into budgetary reserves.”8

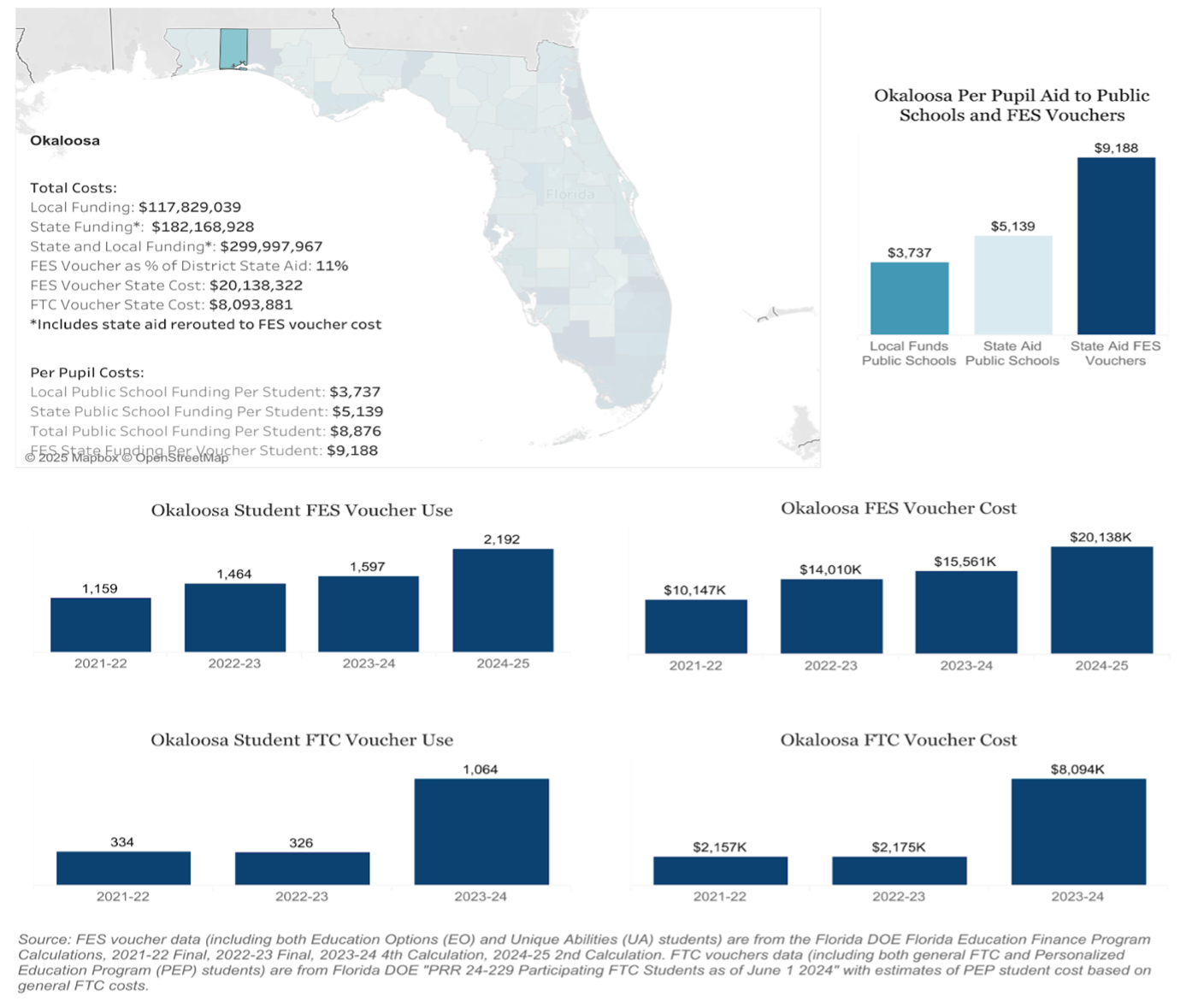

Look at the staggering cost of School Choice policies. Where will Floridians reclaim revenue to pay for the overwhelming debt noose associated with Universal School Choice? State education budgets are funded primarily by taxpayers who do not have school-age children, and Education Savings Account (ESA) programs and their costly components often give families far more than they contribute in taxes.

The percentage of personal annual property taxes confiscated and redistributed to the public education system varies by county; for Okaloosa, it is 49%. Obviously, a significant portion of this comes from property owners who do not have school-aged children; this is a redistribution concern for many. How do we rationalize (or resolve) the inequality and the cost to the state associated with School Choice ESA schemes? As it stands, they will give many families far more cash than they contribute in taxes (while others contribute in taxes and get nothing). Take, for example, a family with three school-aged children in Okaloosa County paying $9,000 annually in property taxes. Roughly $4,500 would be redistributed to the public school system. If this family were to opt in to take the ESA (known as “voucher” in some states), they would receive a little more than $21,000 in one year for their three children, leaving Florida with a $16,500 debt difference.

This, of course, would be much magnified for families with more kids or families not paying property taxes. Over the 12 years of educating these three children in one family, Florida would build up a whopping $171,000 debt. In other words, it would take 38 property taxpayers paying into the education bucket (at the same property tax bracket) to offset this single family’s vouchers. As the incentive for this drives more families to make this choice, does Florida have enough taxpayers to redistribute this much money? Once other educational institutions catch on to what families are receiving, what will happen to the cost of tuition? Will this raise education quality or just tuition? (One could look at what has happened to colleges and universities to answer that question!).

Florida’s Projected School Choice Debt

YEAR 1:

$9K property tax x 49% = $4,500 in collected taxes going to the Florida school system.

- ESA = $7,000 (low estimate) per child X 3 children = $21,000 received by School Choice ESA family. Florida debt: $16,500 ($21,000 given – $4,500 collected = – $16,500).

YEAR 2:

$16,500 x 2, Florida accumulates a $33,000 liability.

- 3 years out: 21,000 in: 13,500

- 3 years out: 42,000 in: 13,500

- 3 years out: 63,000 in: 13,500

- 3 years out: 63,000 in: 13,500

- 3 years out: 42,000 in: 13,500

- 3 years out: 21,000 in 13,500

- Totals: 252,000 in 81,000

Total Costs:

Presuming three kids, each three years apart, taking ESA for their entire school career (12 years), and property taxes = $9000 ($4500 going to Florida school system). This would lead to $81,000 collected by Florida for its school system and $252,000 paid to the family. The overall debt faced by Florida for this one family would be $171,000.

Florida’s Funding Problem

A recent musing hinted at a proposal that many Floridians would love to see but would certainly explode the concern of how Florida might pay for School Choice: Governor DeSantis expressed support for abolishing property taxes in a February 13, X post, stating, “…taxing land/property is the more oppressive and ineffective form of taxation.” Although any such proposal is a long way from becoming a reality, abolishing property tax would shift an even bigger bill for School Choice to some other aspect of the state.

The Florida Legislature seems to see liberty and independence in education differently, thereby either willingly or unwittingly perpetuating UNESCO’s goals. According to January 15, 2025, Appropriations Committee on Pre-K-12 Education, “Florida Education is funded primarily (approx. 89%) from state and local funds, which provides a lot of flexibility over the use of the funds”—89%! How will Florida sustain this debt pace, and how will this debt accomplish, in the words of Governor DeSantis, an “Education Freedom” victory: decreasing its budget and increasing education progress? This goal is an insurmountable feat historically unfulfilled by any state in the nation. Truth is, the rising costs associated with School Choice funding schemes are incompatible with the propagation of freedom; with the shekels come the shackles. Instead, they breed dependency. They breed selfishness. They breed bondage. Instead of framing School Choice as a refund, we should recognize it as a redistribution of collective funds from fellow Floridians who have no representation regarding how the money in those School Choice accounts is spent. Essentially, this results in a taxation without representation scenario.

- What about families who have more than three children?

- What about those who do not pay as much as our family in annual property taxes?

- What about those who do not pay property taxes?

The Better Choice for Florida

While School Choice aims to help students escape failing public schools, the root causes of failure—coercive funding, public oversight, bureaucratic standards, and lack of accountability—remain. In fact, these issues are a direct result of government funding and control, not only within the State of Florida but throughout the nation. By bringing taxpayer dollars into private and homeschool settings, we will inevitably invite the same issues to all education options. If we truly want to be liberated from UNESCO’s trap and for children to escape the domain of public education, we must keep private education private by protecting it from government funding, oversight, and regulation.

Education independence is possible when funded by the family, so the family remains autonomous from the state and accountable only to God for how they spend their own education dollars. Let us seize an education model that is privately funded and independent. Let us not be held captive. Let us recapture liberty and unite for real school choice: Choose Education Independence. You are not alone.

_____________________________________________